Editor’s Note: The following is an excerpt from Orrin Woodward’s book, Resolved: 13 Resolutions for Life.

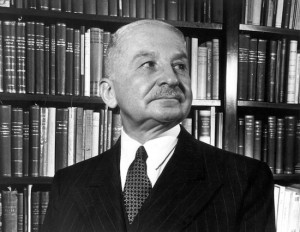

Ludwig Von Mises, an Austrian economist, stood for truth against the economic trends of his day.

Ludwig Von Mises, an Austrian economist, stood for truth against the economic trends of his day.

He defended free enterprise and classic liberalism when nearly all were stumbling over each other to receive perks and preferment offered by governments looking for professors to teach the joys of government intervention and economic controls.

Many economists understood intellectually the errors in the Keynesian policies, knowing that government spending sprees would only lead to massive debt and unemployment.

But through choosing preferment over principles, the Keynesian economists surrendered their convictions for conveniences, riding the Keynesian wave to career advancement.

Conversely, Mises, steeled by his character and resolve, was a lone voice crying in the wilderness. He refused to go along with the deceit and repeatedly pointed out the logical fallacies inherent in Keynesian economic policies.

Persecuted by Statists

This wasn’t a popular stand in the first half of the twentieth century. In fact, Ludwig and his wife, Margit, barely made it out of Europe ahead of the Nazi blitzkrieg.

Jorg Hulsmann, author of The Last Knight of Liberalism, writes:

“Mises was two months shy of his fifty-ninth birthday. He was on the invaders’ list of wanted men. Two years earlier, they had ransacked his Vienna apartment, confiscating his records, and freezing his assets. Mises then hoped to be safe in Geneva. Now nowhere in Europe seemed safe. Not only was he a prominent intellectual of Jewish descent; he was widely known to be an arch-enemy of National Socialism and of every other form of socialism. Some called him ‘the last knight of liberalism.’

“He had personally steered Austria away from Bolshevism, saved his country from the level of hyperinflation that destroyed inter-war Germany, and convinced a generation of young socialist intellectuals to embrace the market. Now he was a political refugee headed for a foreign continent.

“The couple arrived in the United States with barely any money and no prospects for income. Mises’s former students and disciples had found prestigious positions in British and American universities (often with his help), but Mises himself was considered an anachronism. In an age of growing government and central planning, he was a defender of private property and an opponent of all government intervention in the economy. Perhaps worst of all, he was a proponent of verbal logic and realism in the beginning heyday of positivism and mathematical modeling. No university would have him. Margit began to train as a secretary.”

Over the next decade, husband and wife would slowly rebuild their lives in America with Mises find new allies in his fight for truth.

In the midst of these challenges, he published his most important book, Human Action. It would earn him a following whose admiration and devotion were beyond anything he had known in Europe.

With his courage and logic, Mises identified the long-term consequences of socialist and fascist errors, strengthening the growing intellectual resistance to Statism.

Mises was a man of character, a man without a price, living his life by Virgil’s Roman motto, “Tu ne cede malis sed contra audentior ito,” which translates, “Do not give in to evil, but proceed ever more boldly against it.”

Mises proceeded to do just that. The late Dean of the Austrian School, Murray Rothbard, one of the greatest economic minds and good friend of Mises wrote:

“Holding these views, and hewing to truth indomitably in the face of a century increasingly devoted to statism and collectivism, Mises became famous for his ‘intransigence’ in insisting on a non-inflationary gold standard and on laissez-faire.

“Effectively barred from any paid university post in Austria and later in the United States, Mises pursued his course gallantly. As the chief economic adviser to the Austrian government in the 1920s, Mises was single-handedly able to slow down Austrian inflation; and he developed his own ‘private seminar’ which attracted the outstanding young economists, social scientists, and philosophers throughout Europe.

“As the founder of the ‘neo-Austrian School’ of economics, Mises’s business cycle theory, which blamed inflation and depressions on inflationary bank credit encouraged by Central Banks, was adopted by most younger economists in England in the early 1930s as the best explanation of the Great Depression.”

At a time when the crowd was streaming toward Statism, whether in the form of Nazism, Fascism, Socialism, Communism, New Deal, Fair Deal, etc., Mises rejected the blatant errors in each, overcoming the tides of the time through thinking deeply on the underlying principles.

Regardless of the personal and professional cost, Mises refused to teach what he knew wasn’t true, even though opportunities abound if would would go with the economic flow. Mises could not do this and maintain his intellectual integrity, for he knew in his heart that Keynesianism was wrong.

Rothbard again, shares:

“For Mises was able to demonstrate (a) that the expansion of free markets, the division of labor, and private capital investment is the only possible path to the prosperity and flourishing of the human race; (b) that socialism would be disastrous for a modern economy because the absence of private ownership of land and capital goods prevents any sort of rational pricing, or estimate of costs, and (c) that government intervention, in addition to hampering and crippling the market, would prove counter-productive and cumulative, leading inevitably to socialism unless the entire tissue of interventions was repealed.”

Today, Mises looks prophetic having predicted the severe economic disruptions in the economy by society’s acceptance of Keynesian errors.

With the West economic malaise in full bloom, gutted through years of inflationary spending and soaring debt loads, nearly everyone now recognizes that Mises was right all along.

Few will ever comprehend the level of courage it required for Mises to sustain the personal and professional abuses he received. Yet somehow, he never wavered in his belief that time would eventually prove him right, even if that meant from the grave.

Intellectual truth meant more to Mises than anything else, because a person of character understands that following truth is more important than rewards, recognition, or professional perks.

Time has certainly proven Mises right. Government intervention, far from being a modern day elixir, has damaged economies and markets wherever its poison has been imbibed.

Sadly though, once economic error sinks into the mind of the body politic, rooting it out takes time and effort, but it must be done. As Mises stated in Human Action,

“Economics deals with society’s fundamental problems; it concerns everyone and belongs to all. It is the main and proper study of every citizen.”

All citizens should study the history of political, economic and spiritual freedoms, the very freedoms that undergird the liberties enjoyed today in the West.

Follow the Money

If Mises pointed out the fallacies of inflationist and socialist policies in the 1920’s, then why did the West proceed for nearly a century on a spending and borrowing binge, resulting in the near bankruptcy for most governments of the West? The answer revolves around character, or more pointedly, lack of character.

“Follow the money” (FTM) is the motive behind most politician’s questionable behaviors. FTM along with its brother “something for nothing” (SFN) combine to make a powerful force in overcoming principles and character wherever they are allowed to prosper unchecked.

Since most people have a price, educators and politicians FTM into supporting Keynesian policies and are rewarded for selling out their character and supporting faulty economics rationalizing their sell out by the pot of gold offered to them at the end of the rainbow.

This behavior created the current that Mises opposed in his battle for truth against errors. Mises insisted on a gold standard to end political-induced inflation.

Inflation: The Hidden Tax

Politicians sell out their character for inflation because they are always short of two things in modern democracies – money to buy votes and votes to obtain further money.

In the past, a politician could not spend government money unless he raised revenues through increased taxes. Since tax hikes were highly unpopular, he feared losing his elected position; therefore, he restrained his appetite for spending in order to remain popular with his voters.

Today, however, through the “joys” of Keynesian economics, this check to poor behavior is gone. Politicians can now spend more money than taxes raise indefinitely, without having to even suggest increasing taxes.

They do this by inflating the money supply through printing fiat paper money (monopoly money), calling it legal tender. Keynesian policies have given Western governments an unlimited money supply to buy further votes without raising taxes, thus avoiding the ire of the fooled electorate.

The inflated money loses its monetary value as it’s diluted within the economy, but Keynesian politicians don’t seem to mind. They are willing to sacrifice the citizen’s wealth through inflation for their personal benefit in money and votes.

What makes inflationary policy so devious is that it isn’t easily understood by the people. Politicians hide behind their Keynesian soundbites while in office, then leave a bankrupt governments as their legacy, long after they are retired.

Indeed, Keynesian economics provided an amenable world-view for current politicians because it condones their SFN inflationary money policies (a secret tax on citizen’s money) without having to risk an election day disaster.

Keynesians can even proclaim to their voters that they didn’t raise taxes, yet secretly they inflate the money supply which is taxing everyone and hurting those most who live on a fixed income and cannot afford the higher prices that inflation produces.

Most politicians, however, are not concerned with the citizens’ long-term wealth, focused instead, upon their short-term need of money and votes to get reelected. In the politician’s mindset, why worry about the country’s long-term viability when he will be out of office and not responsible for the crash?

Politicians quickly learn the game, pandering to the needs of the current voters, even promising more benefits to them, ignoring the long-term consequences of their irresponsible behavior. Their concern for being elected today trumps the downside damage to the country years, if not decades, hence.

Nonetheless, John Maynard Keynes, understood the long-term consequences of his policies, but when confronted, he answered, “In the long run, we are all dead.”

A humorous quip perhaps, but avoiding the underlying issue. Any system that provides current politicians access to future tax dollars in order to buy an election today is immoral on its face.

Indeed, both parties become bidders of other people’s money, promising gifts to current constituents to be paid for by future tax payers, many not yet even born.

When a person comprehends this point, he will understand why Mises was persecuted so vehemently, because he pointed out the illicit nature of the alliance between the State and the Keynesian economic professors, refusing to go along with the inflationary charade parade at the tax-payers expense.

The economists sell out their character for comfort, money, and power gained through supporting popular Keynesian policies. Individuals, in the pursuit of gain, can advance by writing, teaching, and supporting Keynesian theories of government intervention.

But why do most Universities support government intervention in the economy? Can you say FTM? Who is funding nearly every universities in America and the Western world? Is it the same Western governments who benefit from the Universities teaching the flawed Keynesian economics?

The same government, who partners with educators, convincing the masses of the benefit of Keynesian inflationary policies, then rewards the educators through money grants, prestigious university posts, and government advisory roles in the Statist governments. All the professor has to do is promote the popular Keynesian policies to move ahead.

If a person were to FTM, it flows something like this in a simplistic rendition:

- government prints paper money,

- stealing value from all Americans,

- taking some of the money to reward the economic educators (doctrinaires), who write mighty tomes (propaganda) in support of said governments,

- creating a virtuous cycle of advancement for exploiters in both the political and educational fields.

All of these benefits are paid for by the masses, who being ignorant of the scheme, merely wonder why it becomes tougher every year to make a living.

Politicians win by spending money that doesn’t belong to them; economists win by receiving advancements through teaching flawed doctrine; the citizens lose by declining wealth and opportunities, surrendering “we the people” to “we the exploited.”

Mises pointed out the scheme and refused to participate, paying the price for his character-based stand, blackballed from every major university teaching post even though he is recognized as one of the greatest economists of all-time.

Bankrupting the West

Young and impressionable students, not trained to recognize the fallacies of Keynesianism, become susceptible to the propaganda, despite the fact that after five thousand years of recorded history, Statist policies have never worked anywhere.

Even the Kings of Propaganda, both Hitler and Lenin, would be proud of the level of deceit here. Hitler taught, “Make the lie big, make it simple, keep saying it, and eventually they will believe it,” along with, “How fortunate for leaders that men do not think.” Not to be outdone, Lenin espoused, “A lie told often enough becomes truth.”

If economists are rewarded for following the company line, and the companies, in this case, are funded by the government, then it doesn’t take a grand conspiracy theory, but merely an understanding of FTM and SFN, to see why our present economic policies support further government interventions regardless of whether they are bankrupting the Western Nations or not.

What other valid explanation could explain the United States multi-trillion dollar national debt?

It’s hard for anyone to make a character-based stand in the workplace when the boss rewards the bad behaviors and punishes the good ones. People are left in a moral quandary, pitting their money against their morals.

Millions of people surrender their morals for money, engulfing the world in darkness. But when one person sets his soul on fire with truth, his light radiates a path out of the darkness.

This is exactly what Ludwig Von Mises did: He lit a path out of the darkness for others to follow.

Where is the next generation of men and women willing to set their soul on fire for truth?

Where are the courageous citizens, who cannot tolerate falsehoods any longer, who bravely choose to live by Virgil’s quote, “do not give in to evil, but proceed ever more boldly against it”?

****************************

Orrin Woodward co-authored the New York Times bestseller Launching a Leadership Revolution. His first solo book, RESOLVED: 13 Resolutions for LIFE, made the Top 100 All-Time Best Leadership Books List. Orrin was awarded as the 2011 IAB Leader of the Year.

Orrin Woodward co-authored the New York Times bestseller Launching a Leadership Revolution. His first solo book, RESOLVED: 13 Resolutions for LIFE, made the Top 100 All-Time Best Leadership Books List. Orrin was awarded as the 2011 IAB Leader of the Year.

Orrin has co-founded two multi-million dollar leadership companies and serves as the Chairman of the Board of the LIFE Business. He has a B.S. degree from GMI-EMI (now Kettering University) in manufacturing systems engineering. He holds four U.S. patents, and won an exclusive National Technical Benchmarking Award.

He follows the sun between residences in Michigan and Florida with his lovely wife Laurie and their children. Orrin’s leadership thoughts are shared on his blog, orrinwoodwardblog.com.

Speak Your Mind

You must be logged in to post a comment.